09 Feb 2021

In the world of crop insurance, starting out with a high insurance price is ideal. It establishes good coverage from the beginning and guarantees that level of coverage for the rest of the crop year. During the month of February, Multi-Peril Crop Insurance (MPCI) projected (base) prices are being set by averaging new crop future prices for each day the markets are trading. These prices will be used to establish the dollar coverage and revenue guarantees producers will insure their crops for during the crop year. The higher the projected price, the better the coverage.

Not only do higher prices help to determine better coverage, they also help producers if prices decline at harvest time. If a farmer carries Revenue Protection (RP), they are guaranteed a certain level of revenue rather than just production. Here, producers would be protected from declines in both crop prices and yields. If the commodity price declines during the crop year and ends up lower when harvest prices are established, the yield used to trigger a payable claim increases proportionately to compensate for the drop in crop value. If the commodity price increases during the crop year and ends up higher when harvest prices are established, a producer’s guarantee increases proportionately as well. Any production loss then is paid at the higher harvest price.

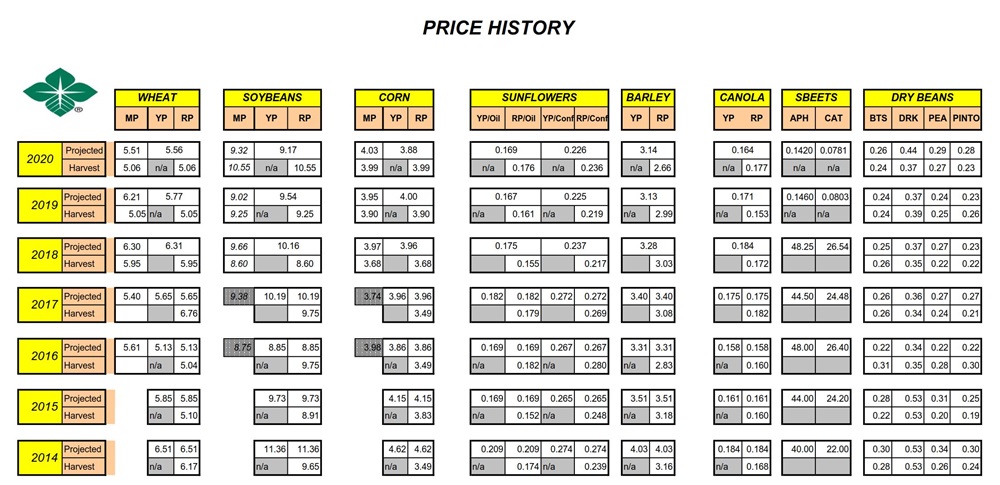

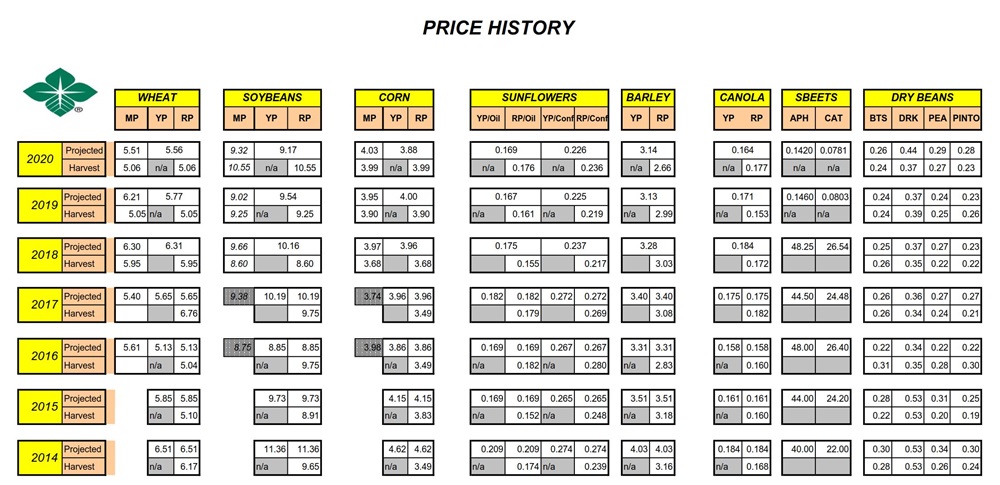

With the recent rallies in the markets, we are seeing 2021 MPCI projected prices averaging at a level we haven’t seen since 2014 (See the chart below). With that, we are seeing better insurance coverage than we’ve seen in a quite some time. The opportunity to begin the year at this higher level is a great place for our producers to start!

Not only do higher prices help to determine better coverage, they also help producers if prices decline at harvest time. If a farmer carries Revenue Protection (RP), they are guaranteed a certain level of revenue rather than just production. Here, producers would be protected from declines in both crop prices and yields. If the commodity price declines during the crop year and ends up lower when harvest prices are established, the yield used to trigger a payable claim increases proportionately to compensate for the drop in crop value. If the commodity price increases during the crop year and ends up higher when harvest prices are established, a producer’s guarantee increases proportionately as well. Any production loss then is paid at the higher harvest price.

With the recent rallies in the markets, we are seeing 2021 MPCI projected prices averaging at a level we haven’t seen since 2014 (See the chart below). With that, we are seeing better insurance coverage than we’ve seen in a quite some time. The opportunity to begin the year at this higher level is a great place for our producers to start!