Winter. It not often a farmer's favorite season, but it certainly is a productive one. Across the country producers are busy closing out the prior year's books, developing cropping plans and building budgets. They're also spending time contemplating crop insurance decisions. Those things are all vital to success, but one item that often gets pushed to the side (especially during low prices!) is a marketing plan. Unfortunately, a marketing plan is where all the work noted above starts to come together, and many times can be the difference between profitability and loss.

So where are we at? It's not a secret that grain markets have struggled. The combination of trade uncertainty, burdensome carryovers and general apathy has muted rally attempts. That does make successful marketing more challenging, but certainly not impossible.

Every January USDA blesses us with a slew of market reports, and this year was no different. January 12 saw the agency release Final Crop Production numbers for the 2017 season, as well as quarterly grain stocks and a look at final winter wheat plantings. There weren't a lot of surprises for the most part.

Corn

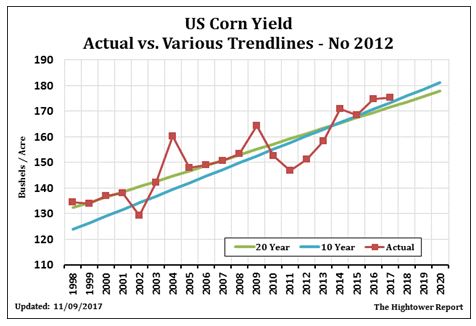

USDA raised corn yields to a record 176.6 bushels an acre. That sounds high, and in fact it was higher than the trade expected. However, as you can see from the chart, minus the disaster of 2012, it's actually just slightly above trend. It was 2012 that was the exception.

On the demand side, the World Ag Supply and Demand report made a few minor adjustments by raising food and industrial use and lowering feed usage, but in the end we increased carryout to 2.477 billion bushels and the largest stocks to use ratio since 2005.

As much talk as there has been about dry weather in South America, USDA did not recognize it as a problem right now. That's largely because around two-thirds of Brazil's corn won't be produced until the Safrihna (2nd crop) and is just starting to be planted. It's something to keep an eye on, but it's simply too early to get worked up about it. Global stocks as a whole did rise, but remain about midline in terms of historical values.

Soybeans

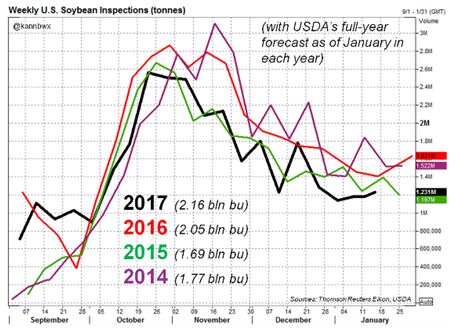

Exports and trade continue to be a focus for this market with USDA providing a cut to projected shipments in the 2017 marketing year. This was largely expected, but as you can see from the chart above produced by Karen Braun of Reuters, there are still issues. Further cuts are possible with Brazil taking over the majority of shipments typically sometime in February, although trade uncertainty does raise to prospect of some counter seasonal shipments down the road.

Offsetting some of the bearishness (and likely saving the day) was USDA cutting soybean yields moderately to 49.2 bushels an acre. This kept the carryout below expectations regardless of export activity, although it remains historically high. Remember that with continued increases in expected soybean plantings, the balance sheet will be pretty sensitive to yield threats.

That's not to suggest that you change your marketing plan, but be aware that an increase in volatility might give you a better shot at hitting your targets.

In soybeans, USDA did slightly acknowledge South America's dryness. Argentinean production was reduced by 1MMT, but that was erased by a 2MMT increase out of Brazil.

Given all this information on corn and soybeans, it's no surprise that basis levels in the upper Midwest have struggled. That's especially true for North Dakota, where grain in storage has skyrocketed and elevators are reporting nearly full storage but little ownership on their stocks. Minnesota and Wisconsin are moderately better off in terms of percentages sold, but on the whole an “average” basis would be an opportunity this year. Remember that futures and basis can be managed separately, but it takes discipline and a plan to capitalize on it.

Wheat

Unlike corn and soybeans, wheat is nearly halfway through its marketing year with final yields already known. Last summer's production issues in Montana and western North Dakota have already allowed for prices to rally, although it might not feel like it since many remain below breakeven levels. As of the last week of January, Minneapolis HRS futures were 35 to 40 cents better than the year prior, with most locations showing a stronger basis as well.

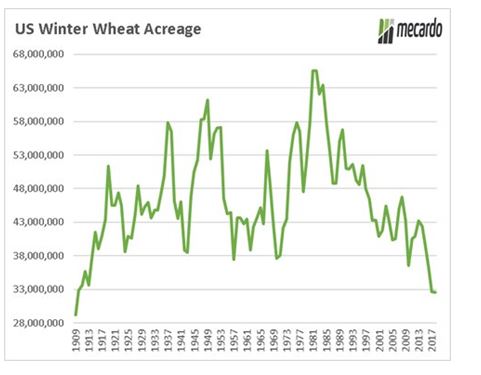

USDA's final winter wheat plantings continued to fall as expected, but still came in higher than expected. That's not good news for a market that is sitting on nearly six months of supply before harvest even begins. Lots of talk about the drought building in the southern plains, but the fact is it can be expensive to trade a U.S. drought in January. That's not to say it couldn't be a problem, but there's also a good chance that spring rains could largely eliminate any issues long before harvest.

As you go in to meet with your Loan Officers and Insurance Specialists in the next few weeks, please think about your marketing plan. What is your breakeven? How many bushels per acre will your APH allow you to sell before harvest? When are you going to pull the trigger on that first sale?

Wanting better prices is a completely understandable and human reaction to our current circumstances. Selling into that environment can bring up a lot of unpleasant emotions and difficult decisions. Constructing a marketing plan and sticking to it can take much of that pressure off. If the market's circumstances change down the road we can always go back and examine the targets, but now is the time to start taking some of that risk off the table. If you have questions on how to do that, call your AgCountry Insurance Specialist and they'll help you get in touch with Rob, Hoot or myself.

Lastly, we'd sincerely like to thank all of those producers who took time out of their busy schedules to attend AgCountry's Marketing Day in Fargo on January 24. It was a great line up of speakers and lots of strong information. We'd also like to thank Gateway Buildings, ProSeed, the Red River Farm Network, Syngenta, RCIS, Crop Risk Services, Rain and Hail, Great American and NAU for their sponsorship and support of this event. Without them it wouldn't be possible.