Spring is finally here! Well, almost anyway. What has arrived in the past few weeks are spring crop insurance prices. True to form for the past six months, corn and soybeans are little changed from last year. Spring wheat prices are much improved, but still not necessarily attractive to many.

As for the more specialized commodities, we’re seeing a little bit of everything on the spring price offerings. The largest spring price decrease for revenue product offerings compared to last year will be seen in confection flours, which will receive a spring price of $23.70 compared to $27.20 last year. On the other hand, the canola spring price is up 90 cents a hundredweight from last year to $18.40. Durum will receive $7.11, a 73 cent improvement.

The ups and downs in the spring insurance prices are pretty reflective of what we’re seeing in the larger market place. Corn, soybeans and wheat are all finding a bit of footing as the U.S. and global markets try to work their way through an abundance of supply. In a few cases we are seeing some headway and those hiccups are offering producers better pricing opportunities than we’ve seen in some time.

March World Agricultural Supply and Demand (WASDE) numbers were released this week. This report is generally more muted in effect with USDA saving any BIG news for the quarterly grain stocks and initial planting intention reports released at the end of the month. Still, the agency did have a few issues to address, most of which stemmed from South American production issues and, to a lesser extent, general demand growth.

Corn

Corn was definitely the darling of this report with USDA offering a much larger than expected 225 mbu cut to carryout. Much of that was due to the big export sales numbers that have come out in the past month to six weeks. On top of that, ethanol crush has been better than expected with margins supported by higher oil prices. Because of that, USDA is now estimating carryout at 2.127 billion bushels, well off the peak estimate in January of 2.477 billion. Historically speaking, 2.1 bbu is still a large number. The stocks to use ratio of 14.3% is similar to the levels seen in 2013 and 2014. Not super encouraging, but it’s clear that the low prices are doing their job in attracting demand.

Globally, much of the market’s attention has been on the dry conditions in Argentina. It’s unclear at this point the precise size of the production damage there. Further muddying the water is Brazil, who is just entering their major corn production season. What is clear is that with Argentina seeing issues and Brazil more focused on shipping soybeans, we are seeing buyers turn increasingly to the U.S. Even with fears over the direction of NAFTA, Mexico has ramped up corn purchases at a tremendous rate! In any event, USDA revised global stocks down to 199.17 mmt, a 14% decline from the peak seen in the 2016/2017 crop year.

Soybeans

It’s really a mixed bag for soybeans in the March WASDE. As with corn, prices have been incredibly focused on possibly production problems in Argentina. They certainly are struggling, but what hasn’t made headlines as often is that Brazil is still looking at a very good crop. Global carryout is coming down, as with corn, but at 94.4 mmt, we’re only down about 2% from 2016. USDA did provide a much larger than expected reduction to Argentine production, but without much effect to the bottom line.

When it comes to U.S. carryout, until this month USDA had yet to address the question of lagging export sales in a major way. For years now, the agency has erred to the low side in their initial estimates. That changed this year, with the agency starting at a very high point. So far it hasn’t panned out. We would note that the last week of Feb did post one of the biggest weeks of soybean purchases this crop year; but one week doesn’t make a trend. That string of purchases combined with South American concerns is largely why we’ve been able to achieve contract highs despite the large carryout.

Regardless, USDA is currently projecting a 555 mbu carryout, which if realized would be the largest straight stocks number since the 2006/2007 crop year. Strong demand is keeping us from coming anywhere near the prices seen at that time, but producers have to be cognizant of where their price risk lies. Is it to the upside or the downside?

Wheat

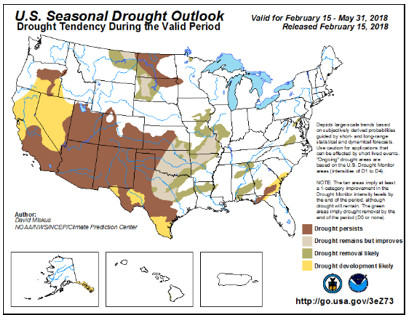

The big discussion in wheat, of course, hasn’t necessarily been on balance sheet numbers as much as the developing drought conditions in the Southern Plains. Winter droughts are hard to put a lot of stock in, but as we move into March the market is likely to start getting a bit antsy. Initial crop conditions for winter wheat on a national basis aren’t released yet, but Kansas, Oklahoma and Texas are out individually. Kansas is reporting 50% p/vp compared to 24% this week last year. Wheat there is just emerging from dormancy and yield determination is still ahead. Meanwhile, Oklahoma is just beginning the jointing process and is reporting 77% p/vp. Kansas City Wheat has rallied more than a $1.20 off its lows in response, but again, spring rains in the next month to month and a half will make a huge difference.

One last point on wheat: the higher prices are cutting export demand. The U.S. is not competitive globally and rallies don’t help that. Accordingly, USDA cut export projections in their March report by 25 million bushels. That amount was immediately added to the projected carryout for 2017.

So what should producers be doing? I think the important thing right now is to define what your risk is. Is there production risk? Certainly, but crop insurance will take care of most of that. Do futures prices offer some chance at profitability? Lock them in on a portion of production. Do you have storage? Make a plan to take advantage of today’s price with a plan to add to it down the road by rolling ahead to a deferred delivery month. Don’t forget about the old crop bushels sitting in the bins either. None of you are going into the 2018 season without a crop plan, and marketing should be no different.

If you have any questions on developing a marketing plan and the things you should consider, give myself, Rob or Hoot a call.