This letter has been a struggle to write, and that’s only a small reflection of the struggle of trying to market grain in the past month! It’s not often we go from at or near contract highs to at or near contract lows, but both corn and soybeans have managed to pull it off in the past 30 days. We’ll get into some of the more nitty gritty in a minute, but I think this month is as good a time as any to discuss market psychology.

One of the biggest mistakes I’ve seen anyone make in commodity markets (or any market really) is assuming that prices act rationally. They don’t. It’s that simple. Markets are largely the result of human interpretation and interaction, and while the market is never wrong, its path can be frustrating to say the least.

One quote I’ve always thought was the best summary that producers need to pay attention to was John Maynard Keyes when credited as saying, “Markets can stay irrational longer than you can stay solvent.” There’s a lot of theoretical debate about whether that’s exactly what he said, but the point remains. You can’t fight the market. You can’t. You’ll lose and it will win.

If we can’t beat the market, how do we shift our pattern of thinking so that the market works for us and not the other way around? In a word, discipline. There are a lot of things we can do to help improve our marketing, but in the end it comes down to execution. Emotions cannot become part of the plan. The minute they do, you’ve lost and handed the power of revenue control to an unknown, faceless entity trading from a computer in parts unknown.

Discipline in marketing is tough and there isn’t an easy way to learn it. However, there are a few things we can do to help guide our path there:

- You have to have goals and a plan. Without this (in writing) you’ve already lost the battle. You can’t map a path if you don’t know where you’re going with things.

- Habits have to change. Producers are busy with so many things, and marketing, to be frank, isn’t always the most pleasant of chores. But, price is half of your revenue equation and you can’t ignore it any more than you can ignore your yield decisions. Check markets (basis and futures) consistently.

- Have a long-term outlook. Not every sale is going to be the best. And hardly any producer I know is willing to sell everything in one fell swoop. So, you must be able to make a decision and then not second guess it.

- To that point, keep a log of sorts. On your marketing plan write the “why” you made the decision you did. Second guessing yourself will accomplish nothing other than creating a roadblock to better marketing performance down the road.

The second point is that it’s easy to get wrapped up in wanting the high of the market, in wanting to beat your neighbors for the best price. The problem is, that same need to win, without discipline, is self-defeating. It will impair your ability to market rather than enhance it.

Lastly, sometimes the best thing we can do is have a third party to simply bounce ideas off of. That could be nearly anyone not directly involved in the growing and storing of the crop.

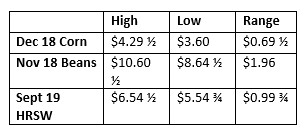

With that out of the way, we can take a better look at why the market has seen such an influx of volatility and there are several reasons. Below is a look at the high to low price range from May 19 to June 19:

Additionally, spreads between crop years are about as wide as they’ve been in recent history. All this is doing is reinforcing the idea that there is plenty of 2017 crop left and that’s not likely to change in the next few months.

New crop contracts, however, are a bit more conflicted, although admittedly any friendliness has been overwhelmed the past few days by trade issues. Political issues as a whole (trade, Renewable Fuel Standard, etc.) remain driving features, probably more so because of the POTENTIAL shrinkage in U.S. balance sheets. That’s not to say any one commodity is on the verge of running out, but the June WASDE report did show some interesting estimates.

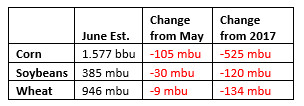

U.S. Carryout

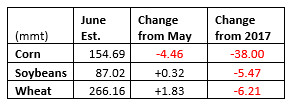

Global Carryout

As you can see, both global and U.S. balance sheets are showing changes. The only change that is getting much attention right now, however, is the global corn carryout which looks to drop nearly 20 percent year over year. Further, if that number is realized, it would mark the lowest stocks to use ratio since the 1970s.

Does that mean producers should wait for a monster rally to sell anything else? No, because at least at this point there doesn’t appear to be a lot of downside risk to that number. That could change, but with the U.S season getting closer and closer to pollination, conditions are about as high as they’ve ever been, historically speaking. Correlations between early conditions and yield aren’t great, but again, its psychology. The fact is there isn’t a perceived problem right now. If something does start to go south, yes, prices are likely to react quickly.

To close this month’s letter, we can’t stress enough the importance of mind over matter when it comes to selling your crop. While a lot of things could happen, we have to look at the situation as it stands now and act accordingly. If you have any questions on how to best do that, please give us a call and we can help start the process of developing a marketing plan.