Is spring finally here? After the crazy April weather it seemed that winter was never going to leave us here in the Midwest. Even though temperatures are finally rising there still seems to be some uncertainty as to when we will see the planters heading to the field. So you may begin to wonder, how does this affect my crop insurance policy?

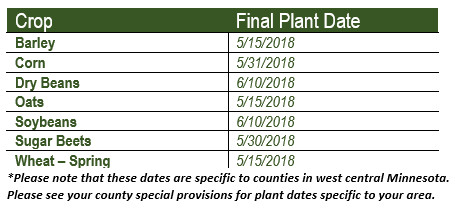

Let's review those final plant dates:

Though we still have time to plant, it is always good to know your options. Prevent Plant is the portion of your Multi-Peril Crop Insurance policy that could potentially pay a claim if you are unable to plant with proper equipment by the final planting date, or by the end of the late plant period.

As a reminder, Prevent plant coverage is figured as a percentage of your crop insurance guarantee and is based only on the projected spring price, not the harvest price. For most crops the prevent plant coverage is 60% of your Multi-Peril guarantee, however there are a few exceptions:

- Corn & Canola 55%

- Sugar Beets 45%

- Potatoes 25%

Eligibility

There are a few things to keep in mind when determining if you are eligible for a prevent plant payment. First and foremost, the issue of prevent plant must be common to the area, so timing is very important. If you choose to plant late when other producers were able to get in the field much earlier and you are then unable to finish due to a cause of loss, you may lose your eligibility for a payment.

The unit structure you elected for the 2018 crop year is another thing to consider. Whether you are insuring on an enterprise unit or optional unit base, you still need to meet the 20/20 rule in order to qualify for prevent plant. This means the prevent plant acres must be the lesser of either 20 acres or 20% of the unit. Meeting the 20/20 rule is easier with enterprise units than optional units. Please talk to your AgCountry Insurance Specialist about your specific situation to determine if it meets the 20/20 requirement.

Another element to think about is if you have planted and harvested a crop on that acreage in any one of the four most recent crop years. If you have not been able to plant and harvest a crop on that acreage due to excessive moisture, for example, you could potentially be ineligible for a prevent plant payment.

Also, if the land has been released from a government sponsored program such as CRP, those acres are not eligible for a prevent plant payment for the first year it is back in production.

Taking Action

If you are concerned that you have a prevent plant situation, as an insured you are required to submit a notice of loss to your Multi-Peril Crop Insurance Agent. This must be done within 72 hours following the final plant date. An adjuster will then determine if you are eligible for prevent plant and what the payment amount will be.

There are many variables that come in to play with prevent plant as far as eligibility, and it can be very difficult for a producer to determine eligibility and potential payment on their own. Consult with your AgCountry Insurance Specialist on specific questions regarding your operation. There is no one size fits all solution when it comes to prevent plant.