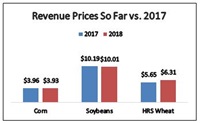

February is here, and with it we’ve begun to track spring crop insurance prices for the 2018 crop year. We’re just short of halfway through the process and it’s certainly possible that we’ll see a change in these levels, but so far prices are very similar to last year.

The other thing February has brought with it is an increase in market volatility. That doesn’t always sound like a great thing but it’s the volatility that’s going to get you some chances to make sales at profitable levels. As long as you have orders in, that is.

Soybeans

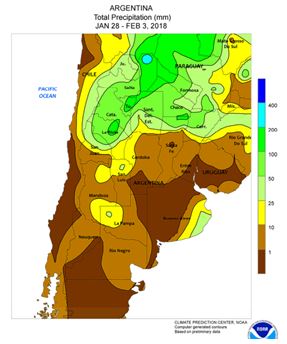

Despite all the talk about not enough or too much rain in South America, early indications are that there isn’t much reason to be concerned. USDA’s Brazilian production estimate on February 8 was 4.11 billion bushels, and many in the industry view that as fairly conservative. Argentina might be a different story, with unusually dry conditions persisting. Unfortunately, that’s more of a meal issue than a bean story.

The strength of the South American crop was also acknowledged in USDA’s U.S. balance sheet, as the agency removed 60 million bushels of export demand from the U.S. and gave it to Brazil. That forces U.S. carryout up to 530 million bushels and the highest projected stocks to use ratio since 2007.

Corn

Corn, on the other hand, has a different story. Argentina’s dry conditions have persisted, which is expected to limit production. That said, the bigger story in February’s numbers was the acknowledgement that the U.S. had its best four-week streak of sales in years, and at least at the moment it looks like the tides have turned for demand. Accordingly, USDA increased their export outlook by 125 million bushels, which came right out of the bottom line. It’s still a very large carryout at 2.352 billion bushels, but headed in the right direction.

Wheat

Wheat changes were pretty muted in February, with USDA cutting exports by 25 million bushels. The change effected mostly Hard Red Winter and White wheat, with Hard Red Spring balance sheets improving by just 2 million bushels on lower than expected flour extraction rates.

Just like last month, drought continues to persist over the Southern Plains, but like we heard from Eric Snodgrass at the AgCountry Marketing Day, those areas could easily be eliminated by spring rains. Dry areas are widespread through the U.S., but unlike 2012, most of those areas are classified as either abnormally dry or moderate drought (the lowest categories). That means easing soil dryness later on will be fairly easy. However, if it’s still dry around mid-May there’s no doubt the market might start to get a little worked up.

Regardless of the details, global stocks of all three grains have stabilized or fallen from their peaks, and that’s good news for a market that’s looking for signs that the worst is over.

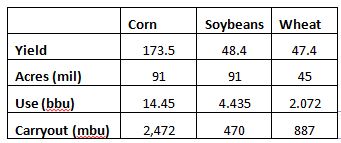

Later this month, USDA will release its first preliminary looks at the 2018 crop year. Some of those numbers were released quietly back in November, but we have a good flavor for what USDA will do during the upcoming Ag Outlook meeting. Below is a projection that should be pretty close to what USDA releases February 22 and 23:

Keep in mind those numbers are extremely subject to change, but that’s what USDA will use for budgeting purposes until further notice. The first firm look at planted acres won’t come until March 30, and until then we’ll be subject to the whims of demand.

Long story short, while grain projections are not encouraging, that doesn’t mean there won’t be opportunities. There certainly will! However, those chances will be generally shorter in length and be offered a bit less frequently than a few years ago.

By this point, producers should have a good handle on their production plans for 2018, as well as the breakeven prices they’ll need to make a profit. Combine that knowledge with the protection provided by crop insurance, and it’s time to start figuring out where to make those first sales!

There’s not a lot of things more difficult than pulling the trigger, especially with tight margins. To some, it’s a final act that removes any upside potential and with it any thoughts of further gains. Nothing could be further from the truth. That same selling action is also what begins to build the base for profitability. By removing some of the risk from your operation with sales, you give yourself time to focus on better prices as well as look for things like strengthening carry to roll contracts and increase your bottom line sales price.

If you have any questions about the markets or what options might be available to you in building a marketing plan, please contact Rob, Hoot, or myself and we’d be more than happy help you.