Last month I said spring was almost here, and 30 days later it appears we’re still waiting. While the weather doesn’t look like it wants to be cooperative, grain markets have been offering a glimmer of hope for many. We’ve finally seen a good sized rally with new crop corn and wheat contracts trading near levels last seen in July and August. Soybeans, overcoming tariff threats and a host of other market turbulence, are trading near contract highs.

So what’s been the spark behind the rally? That’s a point up for debate on several fronts and likely includes further declines in Argentinean soybean prospects, as well as the fact that the market was looking for more prospective acres of both corn and soybeans. Let’s take a look at what’s gone on in the market place over the past few weeks…

Soybeans

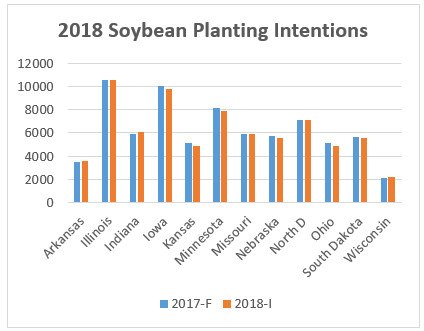

The new crop USDA season officially kicked off March 29 with the agency’s release of prospective planting intentions. The general expectation prior to the release was for some steep growth in bean acres. Cash prices nationally appeared to offer more profit opportunity and there’s also some optimism that bean prices will usually offer you ‘something’. It was true that bean acres did eclipse corn for the first time since the early 80’s (that time due to PIK), but total intentions of 88.98 million was two million acres short of the trades pre-report estimate and one million less than last year.

Globally, the Argentine crop is basically done and being harvested. USDA sliced a massive 257 million bushels off of their production estimate in the April WASDE, but added 73 million bushels on to Brazil’s. That still wasn’t enough to keep Brazil’s bean carryout from falling dramatically as they try to make up the Argentine shortfall and pick up more export business with China, and the world ending stock estimate of 90.8 Million Metric Tons (MMT) is down nearly 4% from last month’s estimate.

Corn

Similar to soybeans, corn prices benefitted from a surprise low acreage number which came in at 88.02 million, a full 1.4 million less than the trade was looking for. The largest declines were in North Dakota (-10.8% from last year), Kansas (-7.3%) and Minnesota (-6.8%), but heart of the corn belt states like Illinois and Indiana saw acreage declines as well.

The loss of production from last year combined with the use of a “trendline” yield of 174.4 bushel an acre (that’s trend excluding 2012, so more aggressive than some are using) leaves a carryout of just under 1.9 billion bushels for the 2018 crop. A yield of 170 (which is trend with 2012 included), drops that back to 1.48 billion bushels. Either way, it looks like there’s a chance the balance sheet will tighten nicely in the coming year, which should offer support until we have a better idea of yield and actual planted acres. We also need to pay attention to political risk from debates over the Renewable Fuels Standard which appear to be heating up again.

On old crop, balance sheets have come off of the worst projections posted back in January. Quarterly grain stocks did come in higher than expected, causing USDA to adjust their 2017 carryout projection higher. They did this through the usual method of cutting feed demand, but even so, we remain less than two months ago. Globally, the drought in Argentina again came into play with corn production dropping just below the average trade estimate. Total global corn carryout is estimated at 197.78 MMT, down 1.4 MMT from March and a huge 33.1 MMT less than last year (a 14.4% decline).

Wheat

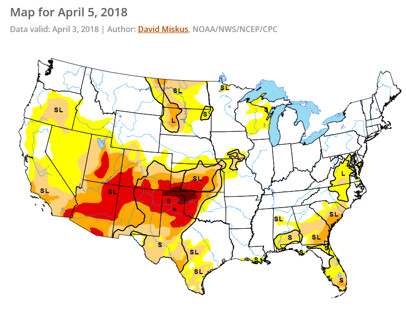

Of the three major grains, wheat has probably had the wildest ride with winter wheat prices affected by drought in the Southern Plains and spring wheat prices dropping sharply on big acres. Initial planting numbers from USDA showed intentions of 12.6 million acres, up from last year and well above the average trade estimate. North Dakota alone is up more than a million acres from last year, while Minnesota is up 540,000 from 2017.

That news dropped prices back to the level seen last year at this time, but weather has since taken the lead. The persistent snow and cold temps across the Northern Plains mean it now looks like it will be around May 1 before any major field work is done. Those delays aren’t overly meaningful for corn and beans, but it could make wheat look less attractive than it did in February when the planting survey was done.

For old crop, the picture didn’t improve with the stocks report. While the number wasn’t shocking, it did reinforce that wheat is not being used as rapidly as expected. This is largely because of cheap corn. Wheat had had a harder time working into rations as well as hoped.

Globally, supplies continue to grow with USDA now projecting a record 271.22 MMT carryout. That’s 2.33 MMT higher than last month and 16.62 MMT larger than last year. Russia maintains its dominance in the world market, something that’s expected to continue for the foreseeable future.

Summary

The real question now is how are you prepared to handle these opportunities? One month or six weeks ago it would have been tough to imagine new crop soybeans at new contract highs despite tariff threats and what’s looking like a late spring. But here we are and we need to make a decision about how much risk we want to carry into the planting season.

On new crop corn, last year’s contract high for December was somewhere in the neighborhood of $4.18 which was seen mid-summer amid growing drought fears. As we get to planting, December 18 contracts are already at those levels. For most producers there’s at least a chance at profitability if you’re willing to make a move.

If you have any questions on the markets and how it might affect you, please feel free to give us a call.