After months of discussion and waiting, USDA finally gave us their first official look at the 2018/2019 crop year! Whether it was worth the wait or not remains to be seen, especially since these estimates will undoubtedly make some big changes before it’s all said and done. There were, however, some hints as to why prices have rallied as nicely as they have this spring and some ideas on what to keep an eye on through this year.

Corn

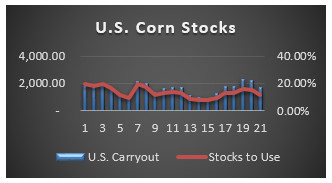

Usually we start this column with soybeans, but the May WASDE report pushed corn and its global balance sheet firmly into the spotlight. In terms of old crop outlook, there wasn’t much new. Carryout was projected at 2.182 billion bushels, pretty much right on expectations. The first estimate on the 18/19 crop was 1.682 billion bushels, which by itself represents a 23 percent drop and would be the lowest U.S. carryout in five years (although still pretty comfortable). Again, however, not out of the realm of expectations.

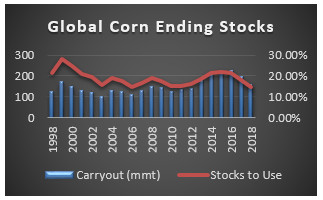

The big surprise, came in the 18/19 global numbers with USDA issuing a first estimate of 159.15 mmt. Their estimate states a whopping 35.69 mmt decline from the 17/18 crop year and would be the lowest since 2012/13 in absolute terms and the second tightest stocks to use ratio on record. To put in more practical terms, roughly equivalent to 1.4 billion bushels or the entire U.S. carryout! To be fair, there had been a few private analysts not all that far off prior to the report, but the trade as a whole viewed them as outliers. So what’s going on?

The first few items are pretty obvious. As mentioned, U.S. carryouts are projected to decline by around 500 million bushels, which would account for about a third of the decline. The next issue is China, for which USDA is penciling in for another 749 mbu decline in carryout. That’s due largely to increased demand for feed and ethanol (remember they are on the verge of their own mandate). The last few hundred bushels are accounted for through a few odds and ends but generally reflect growing feed demand across the globe.

The market’s reaction to such a seeming shock was, well, a surprise. This is the part of the letter where we remind producers that this is why we have a plan BEFORE reports. Failure of a market to rally after the release of bullish news is a big hint that maybe the market has already priced that in. In fact, the International Grains Council on May 1st issued an estimate that called for a 15 percent decline in global stocks.

Soybeans

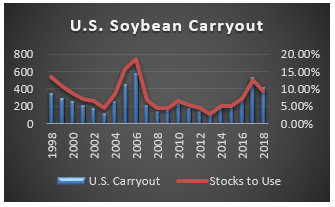

USDA provided a second blessing this month with a lower than expected initial estimate for 18/19 U.S. Soybean stocks. The trade was looking for a number similar to the mid 500’s; more or less in line with what we see today. Obviously in May, there isn’t much in the way of production concerns, so the change was solely reflective of USDA projecting better than expected demand.

Sounds great, but there are a few things we have to be careful of here. First of all, USDA actually lowered their crush expectations for the U.S. a bit in 2018/19 as Argentina recovers from drought. That will allow them to start crushing at a much more rapid rate, although not until next winter sometime.

That puts the burden of performance on exports, which is a tricky estimate to make this far in advance. USDA’s estimate of global export growth is 5 percent, which is decent. However, the U.S. share of global trade is estimated at just 39 percent, which is a little better than this year but not much. Longer term, the U.S. continues to struggle with competition out of South America. The effects of that will be hard to know until much further down the road, making it more important to plan ahead of time and remove at least a portion of risk during our growing season.

Wheat

With wheat operating on a little different marketing year schedule (June-May rather than Sept-Aug), this month’s WASDE had a little different tone. USDA did publish their first 18/19 balance sheet, but it has added complexity because they also add a production estimate for winter wheat. Spring wheat specific balance sheets won’t be released until July.

Crop production estimates for winter wheat basically confirmed the trade’s ideas of production issues in Kansas and Oklahoma with HRW production estimated 14 percent less than in 17/18. There is a strong argument to be made that USDA should increase the abandonment number they are using in those areas, but with 955 mbu carryout estimated for 18/19, it’s not likely to have a major impact on prices. The fact that 955 mbu is a four year low says more about how tough the past four years have been more than it provides a tremendous amount of upside. But hey, for wheat we’ll take what good news we can get, right?

Globally, USDA is projecting a downtick in carryout but we remain at a 35 percent stocks to use ratio. At this point, we’d suggest that a production issue of major proportions out of the Black Sea would be the best chance for a major rally, or some other unforeseeable event.

Final Thoughts

That’s really the crux of the issue with forward pricing, isn’t it? If we could see the future, these decisions would be much easier. I recently read an article that I think had a good point. We preach “risk management” to farmers, but the words don’t resonate well with a group that is inherently risk tolerant. So instead, I would suggest that marketing is simply part of the business plan.

No farmer would go into the field in April (or May, this year) without having a pretty good idea of what is going to be planted in each field and what sort of chemical and fertilizer program is going to be applied. In fact, several have an idea 18 months out what’s going to happen if for no other reason than agronomy decisions.

Yield, however, is only half the equation. Not having a marketing plan is akin to addressing only half of the revenue outcome for your farm. Not many producers I know would be comfortable leaving half of their revenue up to chance.

Grain marketing is no different. Weather, prices, money flow; all these things will influence our thoughts throughout the year. Framing those decisions in the lens of profitability, margins and achieving our goals for the operation, however, eases the decision making process. Having those goals written down helps ensure they happen.

Hope everyone has a great planting season and if you have any marketing questions, please give Rob or myself a call!

Katie

701-499-2548