There are a few different ways to analyze hail plans. One way is to look closely at payout charts and pick the plan that pays out the fastest or best. Another way to analyze the plans is to look at how much total coverage you can get for the premium per acre. This could be affected by the amount you have budgeted to spend per acre. Often, we see producers start by looking at what their multi-peril crop insurance (MPCI) policy guarantee is. On top of the MPCI guarantee, they can use hail insurance to help cover the top-end bushels for hail and/or wind.

For the sake of this article, I am going to focus on five of the most common hail insurance policies AgCountry writes in west central Minnesota. I will be using Renville County hail rates from one of the insurance companies we write with at AgCountry. These policies include Production Plan 120, Companion 3, Companion 2+, Companion 2-10, and BASIC.

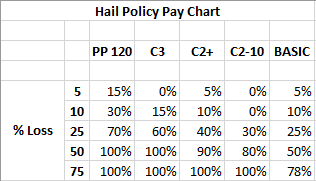

PP 120: 0% deductible (covers from MPCI guarantee up to 120% of approved yield). Max payout at approximately 35% loss.

Companion 3: 5% deductible (Loss - 5 x 3). Max payout at 38% loss.

Companion 2+: 0% deductible (Pays 1 for 1 up to 10% loss) then (Loss – 5 x 2). Max payout at 55% loss.

Companion 2-10: 10% deductible (Loss – 10 x 2). Max payout at 60% loss.

BASIC: 0% deductible (Pays 1 for 1 up to 70% Loss) then (1.5 factor per % loss over 70). Max payout at 90% loss.

Analysis: Based on payouts only, it appears that PP 120 pays the best, regardless of the hail loss experience. The C3 option does not pay on the small loss but catches up quickly. The C2+ option pays at each level but not quite as quickly as the first two. The C2-10 plan eventually catches up but doesn’t pay much on the small loss. BASIC pays at each level but doesn’t max out as early as the other policies.

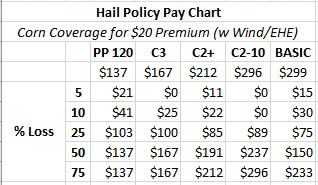

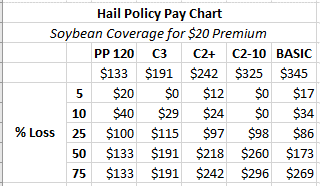

For the next charts, I am assuming a budgeted premium of $20 per acre on both corn (with wind/EHE) and soybeans. This will include the difference in total coverage with the same $20/acre premium, getting closer to an apples-to-apples comparison.

Analysis: Based on the payouts per amount of coverage ($20 per acre premium), it appears that again on smaller losses, PP 120 pays out the best. C2+ and BASIC also payout but not quite as fast as PP 120. When you get to the intermediate losses, PP 120 still is on top. C3 catches up quickly with C2+, C2-10, and BASIC catching up. Intermediate into larger losses is where you are going to see the value in more total coverage with your lower cost per acre plans. C2-10, BASIC, and then C2+ allow you to get more “bang for your buck” on these larger losses.

You can use these different hail policies to cover your operation in different ways. If you want to insure yourself best for the smaller losses, look at the payouts at the 5 to 10% area. You can find the right amount of coverage with the plan that covers best in that range. If you are looking to cover yourself for a larger loss, you can get more total coverage for that situation with a C2-10 plan. C2+ is a very popular plan that is going to pay out on small, intermediate, and larger losses.

If you have any questions or want to review your current coverage, contact your AgCountry insurance specialist or loan officer. If you do not currently have hail insurance in force and/or are curious what a hail rate would be in your area, contact your local AgCountry office. If there is a nasty storm on its way and you want to add coverage quickly, you guessed it, just contact your AgCountry office. We will get you covered (policy can be bound in two hours).

Let’s hope you don’t have to put any of these hail policies to work, but if you do, they will work!