Another crazy year is coming to end where we witnessed prevent plant claims this spring and production losses from drought this fall. Here are a few things to keep in mind to ensure you enter the 2023 crop year on the right foot:

Premium Due Date - The Risk Management Agency (RMA) has extended the Multi-Peril Crop Insurance (MPCI) premium due date to November 30 for the 2022 crop year only.

Production Losses - Please call your insurance specialist if your production on one or more of your units will be at or near your guarantee. Production losses must be filed no later than 15 days after you’re done harvesting.

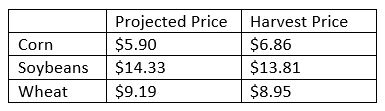

Revenue Protection (RP) Policyholders - The Harvest Price for corn and soybeans was tracked during the month of October and was set on November 1. Below is a chart of the established harvest prices on common crops for our association. As a reminder, if the fall price is lower than the projected price, you could see an adjustment to your bushel guarantee. If the price is higher you would need to experience a true production loss before you are in a loss scenario.

Production Reporting – The MPCI policy requires insureds to report production by unit. Consider your unit structure (Basic, Optional, Enterprise) as you complete your production report. It is the duty of the insured to report each unit’s production within five percent of the actual yield based on your acceptable records. If you fail to do this you will receive an assigned yield for the entire crop/county within the same Basic Unit. For claims and audit purposes, a load ticket cannot be split. As you report production to your insurance specialist, use actual yields and not an overall average for the farming operation. If you are selected for an audit in the future, you must have records to support every bushel reported.

Acceptable Forms of Harvest Records -

- Elevator scale tickets with assembly sheets in the name of the insured

- Insurance company appraisals

- Livestock feeding records

- Automated Yield Monitoring System

- Bin markings or load records by the truck, cart, or hopper to use in conjunction with a bin measurement for the purpose of separating production between units.

It is important that you report production in a timely and accurate manner. This gives your insurance specialist time to review your current year production and check for losses that may have been overlooked. Reporting early also allows your agent to upload your information to the insurance company to ensure an accurate MPCI quote as we plan for 2023.

Crop Insurance Payments - Taxable Income

Please remember that all crop insurance indemnity payments are taxable income. Depending on the type of loss and your personal situation, you may have options as to which year the income is reported. As you meet with your tax professional for end-of-the year tax planning please be sure to discuss your crop insurance proceeds.