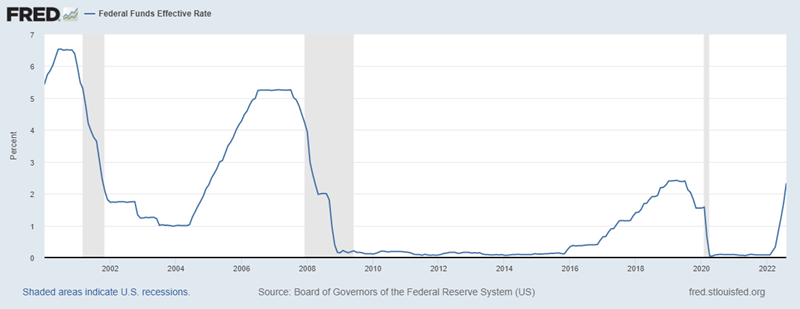

When thinking about current issues facing farmers, ranchers, and landowners today, a rising interest rate environment comes to mind. Long-term and variable rates have increased and may continue to increase as a result of the Federal Reserve’s fiscal policy to stave off inflation. Higher rates may impact land costs and breakeven prices leading to potentially tighter profit margins.

Although rates have been rising, options do exist for farmers and ranchers. AgCountry is here to work with our patrons to provide counsel and offer a wide array of products and services to help mitigate some of the challenges of higher rates. A few options include segmenting loans, amortizing over a longer period, taking advantage of interest rate conversions, and finally, the cash dividend paid out through our patronage program.

You may be asking, what is segmenting a loan? Segmenting is structuring the borrower’s needs into two or more loans with different rate products. This results in a lower “blended” rate thus lowering your debt service cost. For example, you can do a 20-year fixed rate to mitigate interest rate risk along with a portion of the needs on a variable and/or an adjustable-rate loan product to capitalize on a lower overall rate. We know all farms are different, which is why we will work with you to provide sound counsel on what type of structure works best for your operation.

When thinking about the operation’s cash flow, we can look at amortizing the loan over a longer period of time as well, such as 30 years versus a 20-year term. Doing so will help keep land costs down to mitigate the higher interest rates. Again, each farm is unique and there is no one-size-fits-all approach.

The next two options provide a great benefit that is unique to our cooperative.

First, we have the option to convert a loan once every 12 months for a minimal fee. There is no requirement or cost for a new title or appraisal work. Historically speaking on a 20- or 30-year term, there are several times during the life of the loan where conversion options can be utilized. If rates were to drop in the future, you would have the ability to make a conversation and lock in the new rate.

Finally, AgCountry is a member-owned cooperative that pays out patronage to our borrowers on all eligible business. Last year, we paid out a record $76 million in cash dividends. This marked the third consecutive year where AgCountry has achieved its patronage goal of a one percent dividend. Our cash patronage program is another way in which farmers and ranchers can help mitigate a potential rise in interest rates.

No matter the market conditions, AgCountry continues to provide sound counsel and varying options to each of our borrowers. Interest rates have and may continue to increase. However, options exist to assist you in a rising interest rate environment.