On December 22nd, 2017, President Trump signed the Tax Cuts and Jobs Act into law. This is the most substantial tax reform since 1986. Most all of the individual provisions go into effect January 1, 2018, and last until December 31, 2025, unless congress acts to extend them.

Below is a summary of major changes that will affect the farming community:

Section 199A deduction

Section 199 (DPAD) deduction has been eliminated after 2017, which is currently a hot topic. In its place is the new Section 199A deduction. Eligible entities are Sole Proprietorships, S-corps and Partnerships, and the deduction is to be calculated at the personal return level. The deduction will reduce taxable income after AGI is calculated and will not reduce self-employment tax.

How does the new deduction work?

- If taxable income is under $315,000 then the deduction is 20 percent of net business income (Sch F, Sch C, K-1 income)

- If taxable income is above $315,000 then the deduction is limited to the greater of:

- 50 percent of wages paid for labor OR

- 25 percent of wages paid plus 2.5 percent of unadjusted basis of qualified property

The co-op provision in the section 199A deduction allows a 20 percent deduction based on gross sales to a cooperative, which is limited to taxable income. Based on current law all crop sales and patronage dividends to a co-op would be eligible for a 20 percent deduction.

Examples:

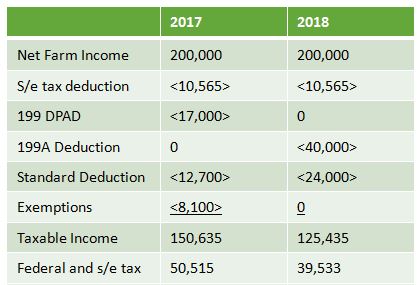

1. Net Farm income is $200,000 and no co-op sales or patronage dividends.

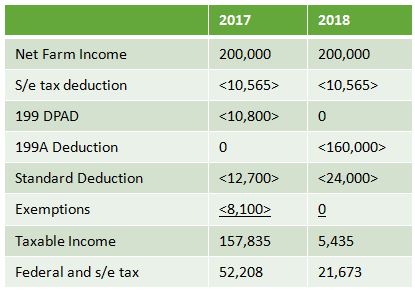

2. Net farm income is $200,000 and coop sales and patronage dividends total $800,000.

The co-op provision could have a profound change in tax liability, and please contact your tax specialist if you have any questions or for the latest updates.

It is important to note that although this is written into law as of now, no regulations have been established yet by the IRS, and there are groups and individuals (even some who worked to get it passed) working to get it reversed or changed. So please keep in mind that all things are subject to change.

Like Kind exchanges

Like Kind exchanges are available for land and buildings, but are not available for personal property like tractors and vehicles. In the past we never recognized the sale of a traded-in asset and would continue to include it on the depreciation schedule with the new asset purchased. In the new law, it is required that we treat the traded-in asset as a sale for the trade in amount the dealer provides. The new asset will go on depreciation for the total cost, not including the trade-in allowance. It will be very important that your farm accounting specialist or tax specialist see all purchase agreements for equipment to recognize the correct sale amount and purchase amount.

Farm equipment asset life

Purchase of new farm equipment will be depreciated over five years and used equipment will be depreciated over seven years. In old tax law, all farm equipment was depreciated over seven years. Also, all farm assets will be depreciated using 200 percent double declining balance compared to 150 percent double declining balance in prior tax law. No change in depreciation life for machine sheds tiling, vehicles or grain bins/facilities.

Section 179

Section 179 has been increased from $510,000 to $1 million. Section 179 can be used on new and used purchases, but cannot be used for machine sheds. Section 179 can be used on an asset by asset basis, and any expense value can be used up to the total purchase price of the equipment.

Bonus depreciation

Bonus depreciation is available at 100 percent expensing starting September 27, 2017, until December 31st, 2022. Bonus depreciation is available for all new and used equipment, including farm equipment, tiling, trucks, and buildings. Bonus depreciation has to be taken by asset class to be expensed. If you purchased a combine, tractor and truck and want to use bonus deprecation, you must use the total cost of the truck OR the total cost of the combine and tractor since the combine and tractor are the same asset class. Bonus depreciation allows less flexibility in picking a value you want to depreciate if it is not the total purchase price of an asset or asset class.

MN depreciation addback

On the Minnesota tax return when section 179 or bonus depreciation are above $25,000 a tax payer is required to addback 80 percent of the depreciated amount, and then will have a subtraction of 20 percent from Minnesota taxable income for four years. When utilizing section 179 or bonus depreciation, Minnesota tax is going to be higher, and will need to be taken into account especially if a traded asset sale is to be recognized and then offset with section 179 or bonus depreciation. Minnesota Legislators have not coupled with the federal tax code in respect to depreciation, and will need to be monitored to see if any law changes occur to couple with federal law.

Corporate tax rate

The corporate tax rate has been changed to a flat 21 percent, which is permanent. For most farming corporations this will actually amount to a tax increase of six percent from the 15 percent bracket if net farm income was kept at $50,000. Corporate tax rates are effective January 1, 2018. For fiscal corporation tax rates will be split between old tax law and new tax law based on the number of days until fiscal year end in 2018.

Alternative minimum tax

Alternative minimum tax (AMT) is still in place, but the exemption amount has been increased from $78,750 to $109,400 for MFJ and $50,600 to $70,300 for single filers. Less people should be subject to AMT as less people are able to itemize.

Estate tax

Estate tax exclusion has nearly doubled to $11.2 million per person compared to $5.49 million in 2017. The higher exclusion is available in tax years 2018 through 2025 unless Congress enacts new law. Portability between spouses and step up in basis is still available. Tax payers will still need to consider any state estate taxes when doing succession and retirement planning for their estate.