Terrain™ is our service for timely insights on topics and trends impacting agriculture, delivered by a team of specialized economic and agriculture analysts. Additional Terrain articles can be found at TerrainAg.com.

Author Ben Laine is Terrain’s senior dairy analyst.

Key Takeaways:

Situation: New Federal Milk Marketing Orders ushered in updates to milk pricing formulas, including increased make allowances and changes to the Class I base price and regional differentials, among other changes.

Impact: Understanding these changes will be important for planning basis and price risk management strategies.

Outlook: Increased make allowances will have the most clear-cut negative effect on component values and milk prices, while the other changes could have a positive effect.

Changes to the Federal Milk Marketing Orders (FMMOs) took effect June 1, 2025. These changes were voted into effect by pooled milk producers (or their cooperatives on the producers’ behalf) in all 11 marketing areas. The new rules modernize milk pricing formulas to better reflect the realities of today’s milk markets.

Last year, I dug into the details and potential unintended consequences of the proposed new rules in “Effects of Federal Order Reform Go Beyond Milk Prices.”

Direct Price Impacts:

- Updated Make Allowances: Decreased values for butterfat protein, other solids and nonfat solids

- Removal of Barrel Cheese: Potential changes in protein values depending on barrel v. block cheese prices

- Base Class I Price: Potentially higher Class I skim milk value due to return of “higher of” calculation

- Class I Location Differentials: Increased Class I milk values, depending on location, due to higher Class I values in certain regions (e.g., the Eastern U.S.)

- Milk Composition: Higher classified milk prices due to higher assumed skim component content

1. Updated Make Allowances:

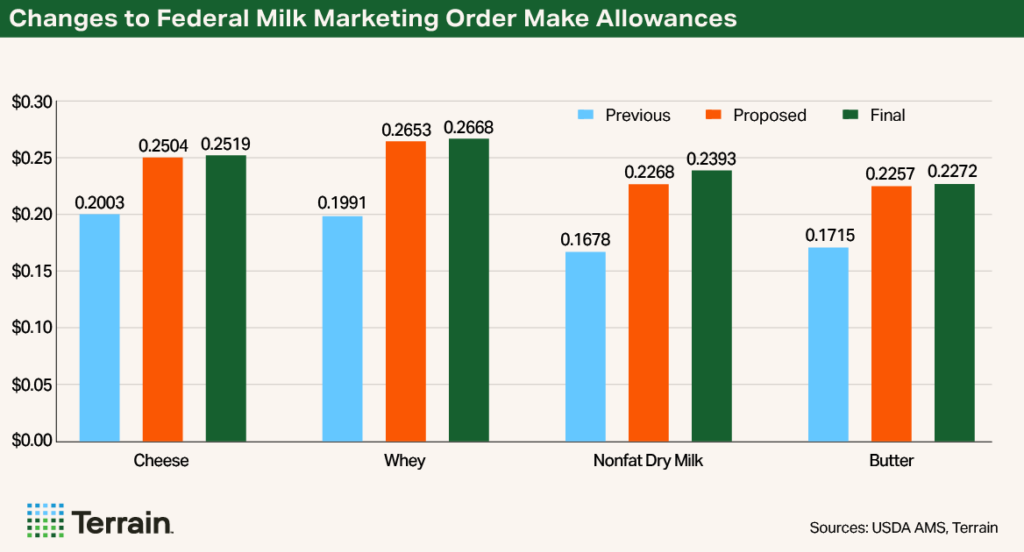

Central to the FMMO reform process was the need to update make allowances in pricing formulas to reflect the higher costs associated with processing milk and its components into manufactured dairy products. Importantly, the make allowances were increased slightly from the original proposed rule before becoming a final rule in response to feedback during the public comment period.

In addition, the butterfat recovery factor in the Class III milk formula will be updated to 91% from 90%.

Impact:

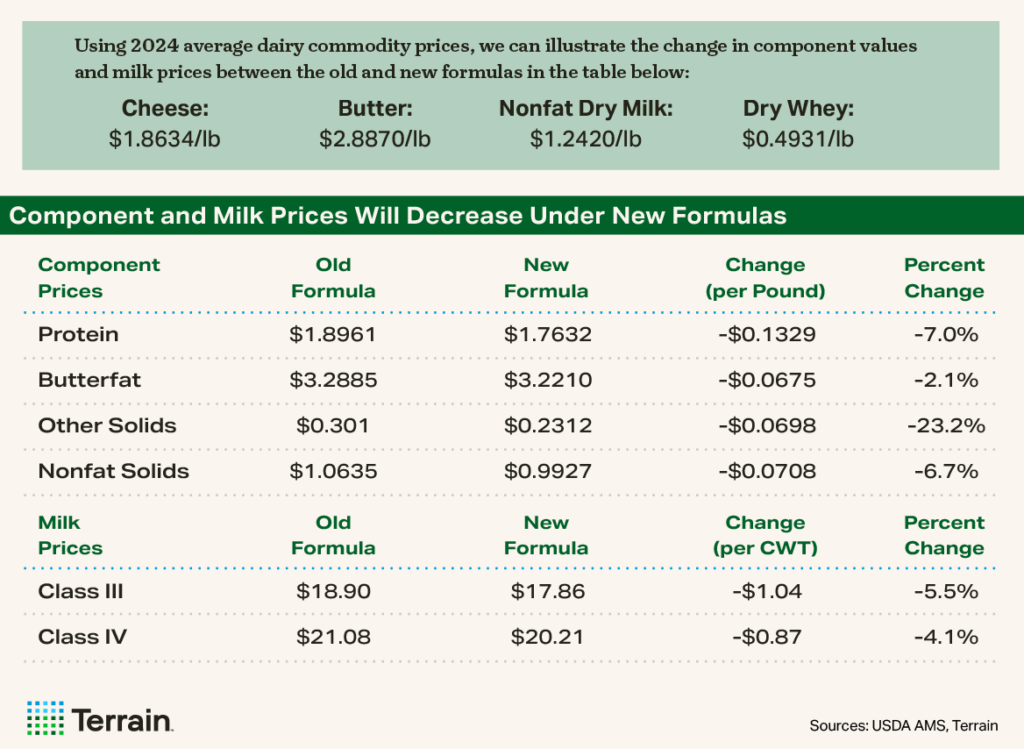

- Increasing make allowance will decrease the component values for butterfat, protein, other solids and nonfat solids. This will decrease classified milk prices.

- If Class III milk prices are reduced while mailbox prices remain stable, this could increase basis risk and add complication to risk management tools such as Dairy Revenue Protection or Livestock Gross Margin Insurance for Dairy Cattle.

- To the extent that lower milk prices are not fully offset by higher class I skim milk prices, a lower U.S. all-milk price would tighten the Dairy Margin Coverage milk margin above feed costs, increasing the probability of payouts for farmers purchasing coverage.

2. Removal of Barrel Cheese:

The price for 500-pound barrel cheddar cheese has been removed from the Class III milk and protein pricing formulas. The price will now be fully dependent on the 40-pound block cheddar price, which was determined to be a better representation of the broader cheese market.

Impact:

- On balance, this would lead to a slight increase (decrease) in protein values and Class III prices if barrel prices remain below (above) block prices most of the time.

3. Base Class I Price:

The skim milk value in the Class I milk price will now be calculated using the “higher of” either the Class III or Class IV advanced skim milk price for the month. This was the method used in the calculation prior to 2019 when the formula was altered to use the “average of” the Class III and Class IV skim milk price plus 74 cents.

In 2020, during the volatility surrounding the pandemic and the USDA’s food box purchase program, the prices for Class III and Class IV skim milk diverged wildly. Under that scenario, producers would have fared better with the “higher of” calculation compared with the “average of” calculation that was in place at the time. Looking forward, however, it is difficult to predict the direct impact of this policy change since it depends on the relative prices of Class III and IV skim milk pricing factors.

There is also a new addition of an Extended Shelf Life (ESL) adjuster that will apply to the base pricing of ESL milk. This adjustment applies only to ESL milk and uses an “average of” mover with a 24-month rolling average adjuster on a 12-month lag. This will help smooth out some of the near-term volatility inherent in monthly Class I milk prices, making it more suitable for ESL products that are marketed over a much longer time horizon.

Impact:

- The price impact of this change should be neutral over time, but during periods of extreme volatility and divergence between Class III and Class IV skim milk values, the return to a “higher of” formula should result in higher Class I values and higher uniform prices paid to farmers.

4. Class I Location Differentials:

The Class I milk differential map assigns different values to each county in the U.S. that represent the varying costs to service the fluid milk market in that location. It is designed to incentivize milk to flow from areas of surplus to areas of deficit.

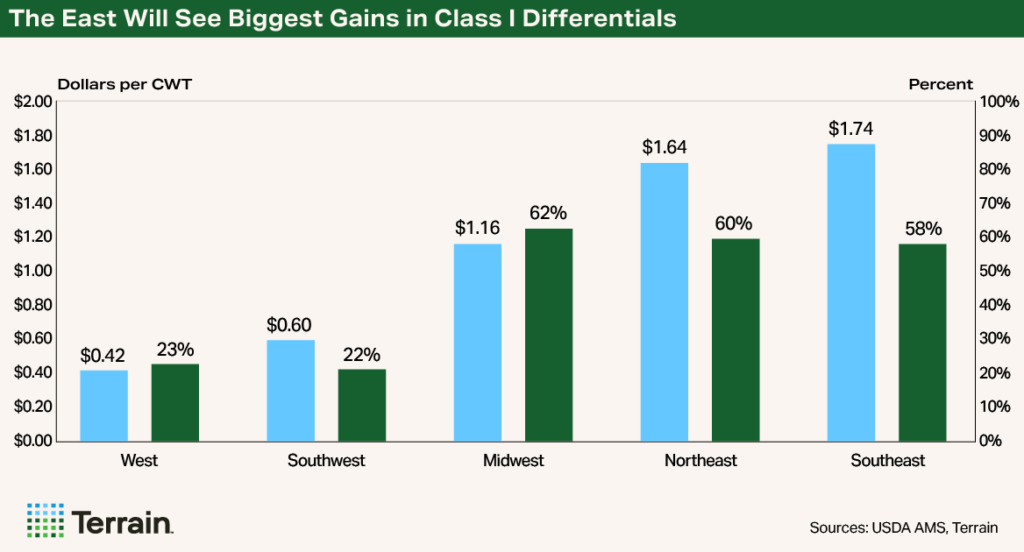

Class I milk differentials have been increased across the board with a national average increase of $1.24/cwt. Certain regions will see greater increases than others, reflecting higher costs of servicing fluid markets in those counties. The most significant increase is in the Southeast region with an average increase of $1.74 compared with the previous differentials, while states in the West will see an average increase of only $0.42.

Impact:

- This will cause an increase in Class I milk values that will increase prices to producers pooled in the FMMO.

- The degree of the impact will vary by county and will depend on the utilization of Class I in each order.

5. Milk Composition: (will take effect Dec 31, 2025)

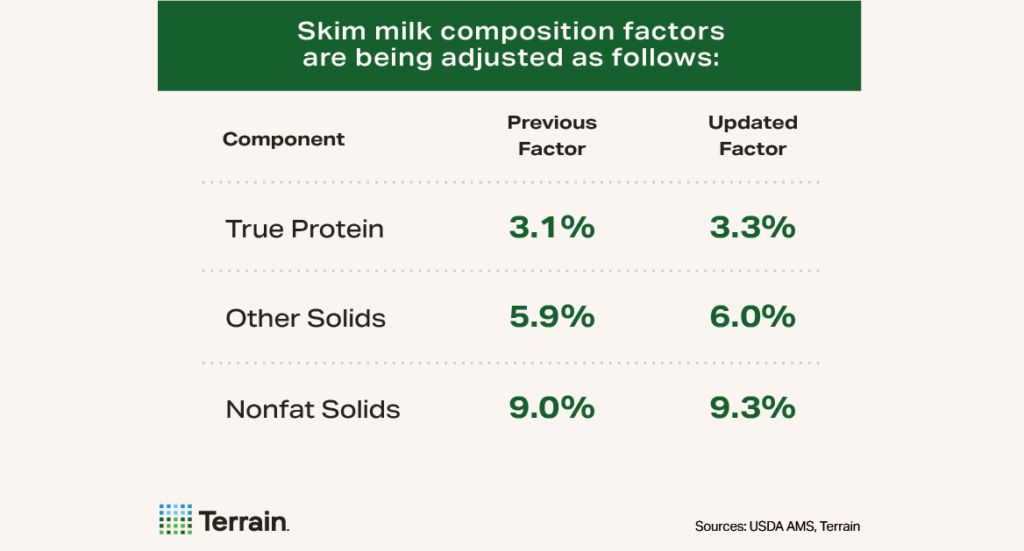

This change was made to align the assumed component content of skim milk more closely with current reality. This is most important for producers in the orders that focus on fluid milk (Appalachian, Southeast, Florida and Arizona) and pay based on butterfat and skim milk pounds rather than components.

- Producers in the four orders that price milk on pounds of skim milk and pounds of butterfat will see their skim milk value increase because of higher assumed component content.

- Classified milk prices (Class I – IV) will increase slightly due to higher assumed skim component content.

Conclusion:

Most of these changes to FMMO pricing formulas took effect June 1, except for the skim milk composition factor updates that have a lagged implementation and will take effect on December 31. Each of these changes will have an impact on milk prices.

Increased make allowances will have the most clear-cut negative effect on component values and milk prices, while the other changes will tend to have a positive effect. The net impact is difficult to predict, but the USDA economic analysis, based on historical averages between 2019 and 2023, indicated a slight increase in total pool value and uniform prices as a result of the proposed rule.

Fortunately, this change coincides with an upward trend in markets in recent weeks that will help soften the impact. The market-driven price increases are overpowering the calculation-driven price decreases for now. Still, understanding these changes, particularly to Class III and IV prices, will be important for understanding basis and price risk management strategies.

When considering the impact these changes will have on milk prices, it is critical to remember that milk prices are still ultimately determined by the market. Federal orders publish minimum prices, but markets typically dictate the mailbox price ultimately received by dairy farmers.

Terrain™ content is an exclusive offering of AgCountry Farm Credit Services, Farm Credit Services of America, Frontier Farm Credit, and American AgCredit.

While the information contained in this site is accurate to the best of our knowledge, it is presented “as is,” with no guarantee of completeness, accuracy, or timeliness, and without warranty of any kind, express or implied. None of the contents on this site should be considered to constitute investment, legal, accounting, tax, or other advice of any kind. In no event will Terrain or its affiliated Associations and their respective agents and employees be liable to you or anyone else for any decision made or action taken in reliance on the information in this site.